Mississauga Real Estate Market Insights for 2025

The Mississauga real estate market in 2025 is poised to experience moderate growth, shaped by evolving economic conditions, increased housing supply, and shifting buyer preferences. Drawing from the Toronto Regional Real Estate Board's (TRREB) latest data and forecasts, this analysis highlights key trends, challenges, and opportunities for the year.

Market Overview

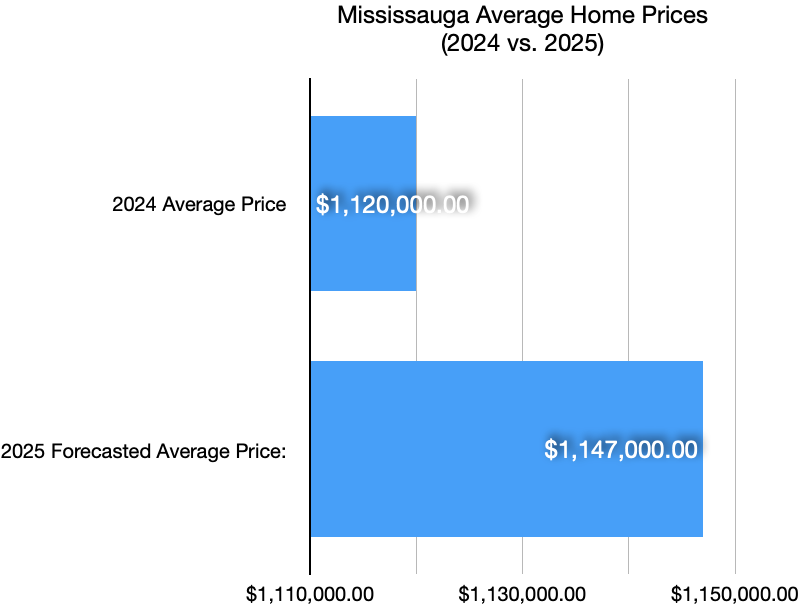

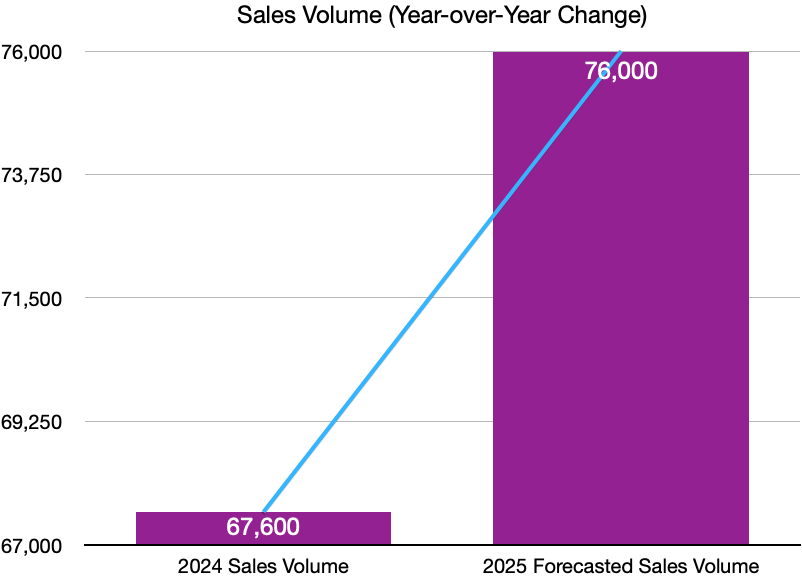

Mississauga, as part of the Greater Toronto Area (GTA), is expected to see a total of 76,000 home sales across the region in 2025—an increase of 12.4% compared to 2024. The average selling price for all home types combined is forecasted to reach $1,147,000, marking a modest 2.6% rise over last year. Price growth will be more pronounced in single-family market segments, including detached and semi-detached homes, while the well-supplied condo market will see slower appreciation.

In February 2025, Mississauga’s average home price hovered around the low-to-mid $1 million range, slightly below Toronto’s average. Sales activity across the GTA declined by 27.4% year-over-year in February due to affordability concerns and economic uncertainty. However, new listings rose by 5.4%, providing buyers with more options.

Buyer Trends

1. First-Time Buyers: Lowering borrowing costs in 2025 will encourage first-time buyers to enter the market. The latest quarter percent rate cut by the Bank of Canada to 2.75% will nudge the sidelined first-time buyers into the market. Affordable options like condos and townhomes remain popular.

2. Move-Up Buyer: Families seeking larger homes are focusing on detached and semi-detached properties as prices stabilize.

3. Investors: With rental demand high due to immigration-driven population growth, investors are targeting purpose-built rentals and multi-unit properties.

Economic Influences

- Interest Rates: The Bank of Canada is anticipated to cut interest rates further in 2025, improving affordability and prompting more buyers to act.

- Trade Uncertainty: Potential U.S. tariffs on Canadian exports could dampen consumer confidence and reduce purchasing power.

- Affordability Challenges: High development charges and taxes continue to impact housing costs despite efforts to increase supply.

- Lowering of Development Charges: City of Mississauga has recently reduced the development fees it charges the builders by a whopping 50% in order to get more homes built to meet the ever-increasing demand.

Housing Supply

Mississauga benefits from a growing inventory in 2025, with active listings significantly higher than in previous years. TRREB emphasizes the importance of increasing "missing middle" housing—townhomes, duplexes, and low-rise multi-unit buildings—to address supply gaps. Purpose-built rentals are also critical for meeting demand.

- Detached Homes: Prices for detached homes are expected to grow moderately as demand stabilizes. These remain a preferred choice for move-up buyers but face affordability challenges.

- Townhomes: Townhomes continue to attract first-time buyers due to their relative affordability compared to detached homes.

- Condos: The condo market is well-supplied, leading to slower price growth compared to other segments. However, condos remain an accessible entry point for many buyers.

Challenges

1. Affordability Concerns: Despite lower interest rates, high home prices continue to challenge first-time buyers.

2. Economic Uncertainty: Trade disruptions and inflationary pressures may limit consumer confidence and spending power.

3. Infrastructure Delays: Traffic congestion and delays in transit projects could impact property values near key hubs.

Opportunities

1. Lower Borrowing Costs: As interest rates decline further in 2025, affordability will improve, drawing more buyers into the market.

2. Transit-Oriented Development: Properties near transit hubs like those along the Hurontario LRT corridor will benefit from increased connectivity.

3. Increased Supply: Rising inventory levels provide buyers with more choices and negotiating power.

Conclusion

Mississauga’s real estate market in 2025 reflects a balanced environment with moderate price growth and increasing sales activity expected later in the year as borrowing costs decline. While challenges such as affordability and economic uncertainty persist, opportunities abound for buyers and investors willing to navigate this dynamic market.

With its strategic location within the GTA and ongoing infrastructure improvements, Mississauga remains an attractive option for families, first-time buyers, and investors alike. The city’s focus on housing diversity and transit-oriented development positions it well for sustained growth in the years ahead.

Have Questions?

It is natural to have concerns in the type of market that we find ourselves in. Give me a call and I will help you find a solution for your particular situation. Call or text me: 647-834-9928.